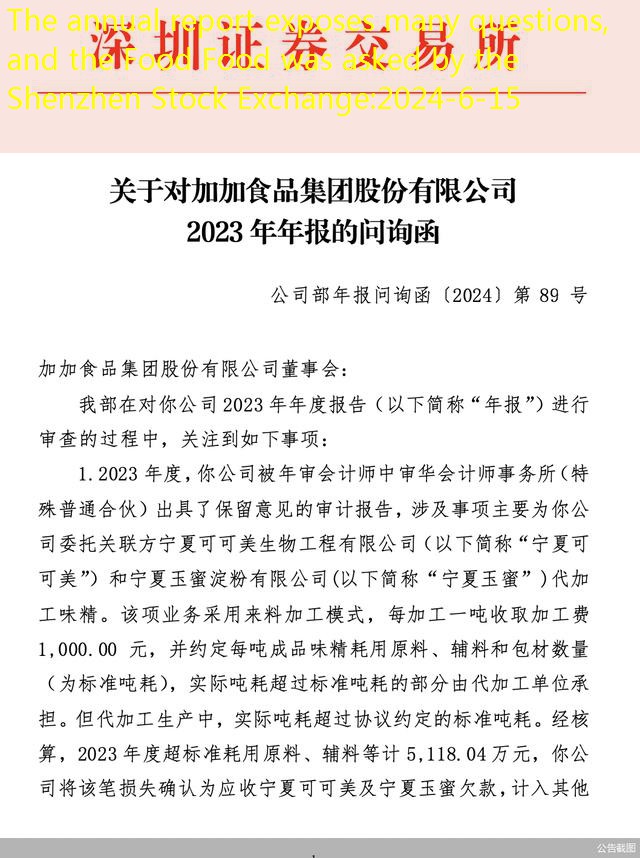

On the evening of May 7, the Shenzhen Stock Exchange issued an inquiry letter to Canada Foods 2023 annual reports, and the letter asked eight questions in a row.On the same day, Gaga Food also received a letter of attention issued by the Hunan Securities Regulatory Bureau, which mentioned that the company had major defects in the internal control and inventory management of related party transactions.After three consecutive years of losses, controlling shareholders and actual controllers, the judicial freezing period is prolonged, other risk alerts, stock abbreviations have been changed from “Canadian food” to “ST plus”, one after anotherIn terms of food, it is undoubtedly worse.

“Eat letter” one after another

Specifically, the Shenzhen Stock Exchange’s inquiry letter focused on multiple issues.Among them, Gaga Foods issued an audit report for reserved opinions in 2023, which involved the items were mainly entrusted to affiliate Ningxia Coco Biological Engineering Co., Ltd. (hereinafter referred to as “Ningxia Coco”) and Ningxia Yumi Starch Co., Ltd. (The following is referred to as “Ningxia Jade Mill”) The business of MSG is processed. This business adopts the material processing model. The actual tonal consumption of the standard ton should be borne by the pro -processing unit, but in the processing and production of the agencyStandard tonal consumption agreed.After calculation, the raw materials and auxiliary materials were consumed in 2023, and the raw materials and auxiliary materials were 511.804 million yuan. In addition, the losses were recognized as the loss of Ningxia cocoa and Ningxia jade honey, and it was included in other receivables.Therefore, the Shenzhen Stock Exchange requested Gaga Food to explain the equity structure and shareholders of Ningxia Coco, Ningxia Yumi, and its cooperation history and internal control of previous business cooperation.

In addition, the Shenzhen Stock Exchange has also paid attention to other seven issues, including the intention of the intention of Hunan Puhe Fund’s foreign equity investment transactions, which was invested by the company, and the interest of the foreign equity investment transaction was not recovered within the validity period of the agreement, and the subsidiary plus (Beijing) (Beijing)Digital Technology Co., Ltd. has occurred in multiple lawsuits, the company’s continuous operating capacity, dealer agency model, the reasons for the decline in product gross profit margin, and the basis for the basis of inventory price preparation.The Shenzhen Stock Exchange requested that Jiajia Food made a written explanation of the above issues before May 21 and disclosed to the outside world.

The regulatory concern issued by the Hunan Securities Regulatory Bureau shows that Garga Food has “major defects” in terms of internal control and inventory management in related parties.The amount, specific terms and performance; the company’s monthly purchase of raw materials, commissioned processing MSG, internal use of monosodium glutamate, external sales monosodium glutamate and inventory inventory;The inventory method of inventory in the factory area.The Hunan Securities Regulatory Bureau requested that Garga Food disclosed immediately after receiving a letter of attention, and replied to the Hunan Securities Regulatory Bureau in writing within 5 working days.

Regarding receiving the inquiry letter and the regulatory concern letter, on May 8th, the relevant person in Giajia Food responded to the reporter of the Beijing Business Daily that the company would disclose the reply letter in the future.

Reputation crisis

When the report was announced in 2023, Garga Food issued an announcement stating that due to the negative opinion of the audit of the financial report, the company’s stock transaction was implemented by other risk warnings.reply.

“Zhan Junhao, a well -known strategic positioning expert, and founder of Fujian Huarce Brand Positioning Consultation, told a reporter from Beijing Business Daily that the well -known strategic positioning experts and the founder of Fujian Huaze brand positioning consultation.It also includes the company’s internal control management and corporate governance structure.The exposure of these negative information will affect investors’ confidence in the company, which will adversely affect the company’s stock price and market image.

Zhan Junhao said that in the audit report, the disclosure of problems such as internal control in the processing of transaction was revealed, which allowed investors to doubt the authenticity and accuracy of Gaga food financial data.In addition, Hunan Puhe Fund invested by the company failed to recover the intention of gold and interest as scheduled, as well as multiple litigation cases of subsidiaries, which reflected that the company had certain problems in investment and operation management.Coupled with the controlling shareholder and actual controller, the person who has become a trustworthy person is executed, and the excellent investment is applied for bankruptcy review, which will exacerbate the reputation crisis of Canada Food.Gajia Food urgently needs to solve the internal control and governance problems currently facing, and ensure that the company’s operation and management are more standardized and transparent.

In the opinion of Jiang Han, a senior researcher at Pangu Think Tank, the continuous losses in the performance of Food’s financial report directly reflected the company’s serious challenges during the operation.The inquiry letter of the Shenzhen Stock Exchange and the Hunan Securities Regulatory Bureau’s regulatory concern letter mentioned in the multiple issues of Canadian food in internal control and financial status, indicating that the company’s management has loopholes and risks.”The imperfect internal control may lead to problems such as mistakes and asset loss of the company, and poor financial conditions may affect the company’s capital liquidity and debt capacity. If these problems are not resolved in time, it will seriously restrict the company’s future development”” Jiang Han said.

On the evening of April 28, the annual report released by Foods showed that revenue was 1.454 billion yuan in 2023, a year -on -year decrease of 13.78%; net profit loss was 191 million yuan.This is the third year of Canada Food’s company. According to the financial report data, in 2021, the net profit of food was 80.16 million yuan, and the loss in 2022 was 79.63 million yuan.Garga Food explained in the 2023 financial report that the reasons for the changes in performance during the reporting period were on the one hand, on the one hand, sales revenue declined, and in 2023 due to the changes in the market environment, the main products were reduced, and the sales price was low. At the same timeThe company’s Zhengzhou Company was discontinued, and the amount of asset impairment loss and the compensation of personnel resignation caused the company’s performance during the reporting period to decline year -on -year; and the increase in advertising propaganda input costs increased, resulting in the negative value of the company’s reporting period of reporting and losses in operation.